The Everett School District Board has voted to put two replacement levies in front of voters after the first of the year. Here’s more from the District.

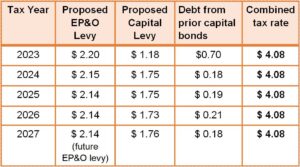

The passing of both the replacement EP&O and capital levies will increase your Everett Public Schools-related property tax rates by an estimated $0.84 per $1,000 Assessed Value per Everett Schools.

Everett School District board of directors voted to put two replacement levies on the February 2022 ballot. The 4-year replacement Educational Programs and Operations (EP&O) levy and the 6-year Capital levy would replace two levies expiring in 2022 and would start collecting in 2023.

Replacing both expiring levies within a stable tax rate, that also addressed the educational needs of all our students, was a primary goal in planning the renewal levies for the February 8, 2022 election.

Having good schools and facilities has a positive effect on our neighborhoods. Better schools help build a stronger community, which will improve our quality of life, keep crime down, and help increase the values of our homes.

“All students should be given the same opportunities regardless of their abilities, backgrounds, or family income,” said superintendent Ian Saltzman about the upcoming levies. “This funding will ensure all students in Everett Public Schools have the same opportunities to learn, grow and succeed.”

Local EP&O levy funding allows us to provide the quality education our community expects for our children, which goes beyond the minimum funded by the state. The proposed renewal levy rate is $2.20 per $1,000 of assessed property value (AV). This is an increase of 27 cents per $1,000 AV. This covers basic operating expenses and includes:

- Special education services

- Additional program offerings such as summer school, early learning,elementary dual language, choice programs, orchestra,family partnerships, and Diversity, Equity & Inclusion (DEI)

- Additional guidance and mental health counseling services, nurses,health room assistants, staff mentors, and positive behavior coaches

- Student transportation

- Safety and security

- Extra-curricular clubs, sports, and activities

- Costs over state funding for full time, part-time and substitute staff

The $325.5 million replacement Capital levy provides funding to acquire, improve, or maintain school facilities in the following categories:

- Technology: Our students benefit from ongoing integration of technology into their learning. $96 million.

- Increased safety and security: Our students will learn in buildings that are made to be safer and more secure. $ 2 million.

- Equal access, same experience: Every student will have the same opportunity to learn in well-functioning, safe and modern spaces. $ 172 million.

- Maintenance and mandatory upgrades: Our facilities are valuable community assets and must be maintained to increase their life expectancy and comply with state-mandated upgrades. $ 54 million.

The passing of both the replacement EP&O and Capital levies will increase your Everett Public Schools-related property tax rates by an estimated $0.84 per $1,000 AV when compared to 2022 and an estimated $0.33 when compared to 2021. However, the new tax rates will still be substantially lower than rates paid by district property owners prior to 2021.

For more information about the upcoming replacement levies, visit everettsd.org/2022Levies.

November 10, 2021

Everett Schools