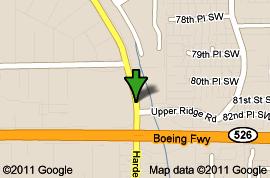

Here's where you can drop off tax forms before midnight but it's just a drop off, they don't sell stamps here

•Make sure your tax return has sufficient postage. First-Class postage is 45-cents for the first ounce and 20-cents for each additional ounce. If you are mailing a number of supplementary forms and schedules with your return, the envelope is likely to weigh more than one ounce.

•The IRS will not pay postage due. Mail with insufficient postage is returned to sender. If you are in doubt about how much postage to apply, use a lobby scale, the scale on an APC (Automated Postal Center) or ask a postal clerk for assistance.

•If possible, mail your return using the pre-addressed envelope provided by the IRS. If you must prepare another envelope, make sure the address is legible and include your return address.

•When mailing your return at a post office not on the list for late pickup, check the times posted on the blue collection box to determine the last scheduled pickup time.

•Remember, postage can be purchased at any Automated Postal Center (APC). Check usps.com for a location near you.

April 17, 2012

Everett